Comprehensive Car Insurance in Tacoma, WA | DMS Insurance Experts

Explore our extensive range of auto insurance services to get exactly what you need, providing you with the most comprehensive coverage available in Seattle and Tacoma. At DMS Insurance, we understand that your vehicle is more than just a mode of transportation—it's an investment, and we are committed to helping you protect that investment with the best auto insurance options tailored to your needs. Whether you need basic liability insurance, collision coverage, or comprehensive protection against a range of risks, we've got you covered. Our team is dedicated to offering personalized insurance solutions that meet your unique requirements, ensuring that you are fully protected on the road, no matter where life takes you.

When you choose DMS Insurance, you’re not just getting an auto insurance policy—you’re gaining a partner who understands the intricacies of vehicle ownership and the importance of protecting your assets. Our insurance agency in Seattle is renowned for its customer-focused approach, providing coverage that goes beyond the minimum requirements to offer robust protection for your vehicle. We cater to a wide range of customers, from new drivers looking for affordable options to seasoned vehicle owners who need comprehensive coverage for high-value assets. With our extensive knowledge of the Washington state insurance market, we tailor our policies to meet the specific needs of drivers in Seattle and Tacoma, ensuring that you have the right coverage for every situation

- Auto

Liability Coverage

Liability coverage from DMS Insurance is an indispensable part of any auto insurance policy, providing critical financial protection for drivers who cause accidents resulting in bodily injury or property damage to others. This essential coverage is not only a legal requirement in most states, including Washington, but it also plays a crucial role in safeguarding your financial well-being. When you are at fault in an accident, liability insurance covers the medical expenses, legal fees, and property repairs of the other party involved, preventing you from facing potentially devastating out-of-pocket costs. At DMS Insurance, we offer liability coverage that is customizable to fit your needs, with various limits and deductibles that allow you to tailor your policy to your specific situation. Our liability insurance policies are designed with flexibility in mind, ensuring that you can choose coverage limits that align with your financial circumstances and risk tolerance. This adaptability is particularly beneficial for customers who own high-value vehicles or have significant assets to protect. Whether you’re driving a luxury SUV or a family sedan, our liability coverage provides the financial security you need to drive with peace of mind. In addition, our policies are backed by the strength of reputable insurance companies like Liberty Mutual, ensuring that you receive top-notch service and prompt claims processing.

Key Points

Legal Requirement: Liability insurance is mandatory in most states, including Washington, ensuring that all drivers have at least the minimum level of financial protection against the consequences of accidents. Without this coverage, drivers risk severe legal and financial penalties, making it essential for anyone on the road. Compliance with state laws not only protects you legally but also provides a foundation for more comprehensive coverage options, should you choose to enhance your policy.

Financial Protection: Our liability coverage is designed to cover the significant costs associated with injuries and damages caused to others in an accident. This financial protection is crucial in safeguarding your assets and ensuring that you are not left vulnerable to lawsuits or massive medical bills. By covering medical expenses, property damage, and legal fees, liability insurance serves as a critical safety net for your finances, enabling you to focus on recovery and moving forward after an accident.

Limits and Deductibles: We offer a wide range of customizable options that allow you to set your coverage limits and deductibles according to your budget and risk tolerance. Whether you need the minimum coverage required by law or more extensive protection, DMS Insurance provides the flexibility to build a policy that meets your needs. This customization is particularly important for those with diverse insurance needs, such as property insurance for homeowners or health insurance to cover medical expenses, ensuring that all aspects of your financial life are protected.

Ideal For

Drivers on a Budget: Our liability insurance policies are specifically designed for those who seek the minimum coverage required by law, allowing them to comply with legal requirements without straining their finances. This makes it an ideal choice for individuals who need essential protection at an affordable price. Additionally, our policies are perfect for those who are balancing multiple financial obligations, such as paying off a mortgage or managing health insurance premiums.

Daily Commuters: For those who spend a significant amount of time on the road, whether commuting to work or running daily errands, liability insurance is critical for protecting against the everyday risks of driving. With our coverage, you can drive with confidence, knowing that you are protected from the unexpected. Our policies are tailored to the needs of Seattle and Tacoma drivers, ensuring that you have the right level of protection for the specific risks associated with urban driving.

New Drivers: If you are new to driving, establishing a foundational auto insurance policy with robust liability coverage is a critical first step. This coverage not only ensures legal compliance but also provides peace of mind as you navigate the challenges of driving. For new drivers, understanding the importance of liability insurance is crucial, and our team is here to help you build a policy that meets your needs while staying within your budget.

- auto

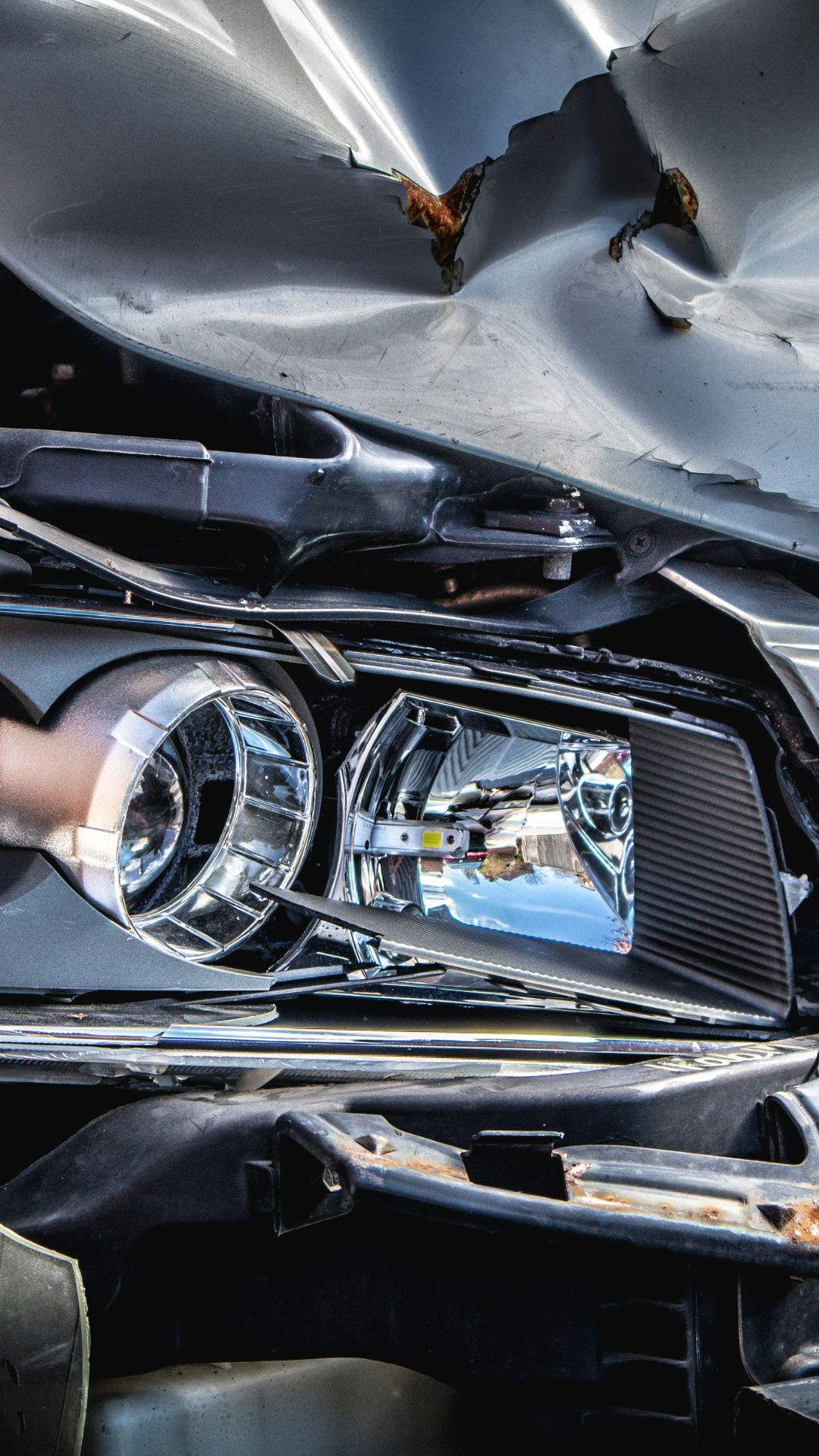

Collision Coverage

Collision coverage is a vital component of any auto insurance policy, offering protection for the repair or replacement of your vehicle if it is damaged in a collision with another vehicle or object, regardless of who is at fault. At DMS Insurance, we recognize the importance of maintaining the value and condition of your vehicle, and our collision coverage ensures that your car can be restored to its pre-accident state, minimizing the financial impact of an accident. Whether your vehicle is financed, leased, or owned outright, collision coverage provides the financial security needed to keep you on the road. This coverage is particularly essential for those who have invested in their vehicles, offering comprehensive protection that is often required by lenders. Collision coverage is especially important for those who drive high-value vehicles or classic cars, as the cost of repairs or replacement can be substantial. Our policies are designed to offer maximum protection, ensuring that your investment is secure no matter what happens on the road. We also offer options to customize your deductible, allowing you to balance the cost of your premium with the level of coverage you need. This flexibility is particularly valuable for those who need to manage their insurance budget while ensuring that their vehicle is fully protected.

Key Points

Vehicle Protection: Our collision coverage is designed to safeguard your vehicle against the financial burden of repairs or replacement following an accident. This protection is crucial for maintaining the value of your vehicle and ensuring that you are not left without reliable transportation. Whether you drive a luxury vehicle, a family car, or a motorcycle, our collision coverage ensures that you can get back on the road quickly and with minimal financial strain.

No-Fault Benefits: One of the key advantages of collision coverage is that it applies regardless of who is at fault in the accident. This means that you can count on your insurance to cover the necessary repairs or replacement costs, even if you are partially or fully responsible for the incident. This no-fault benefit is particularly important in areas with heavy traffic, such as Seattle and Tacoma, where accidents are more likely to occur.

Deductibles: We provide a range of deductible options that allow you to choose the amount that best fits your budget and risk tolerance. By selecting a deductible that aligns with your financial situation, you can control your insurance costs while ensuring that you have adequate coverage in the event of a collision. Our flexible deductible options are designed to meet the needs of a wide range of customers, from those who need basic coverage to those who require more extensive protection.

Ideal For

Vehicle Owners: Collision coverage is particularly important for those who own their vehicles, especially if they are newer models or financed through a lender. Protecting your investment with comprehensive coverage ensures that your vehicle is repaired or replaced if it is damaged in an accident. Our policies are designed to meet the needs of vehicle owners who want to protect their assets while maintaining their financial security.

Urban Drivers: If you frequently drive in high-traffic areas such as Seattle or Tacoma, where the risk of accidents is higher, collision coverage is essential for mitigating the financial impact of a potential accident. Our coverage provides the security you need to navigate busy roads with confidence. We understand the specific risks associated with urban driving, and our policies are tailored to provide the protection you need in these environments.

Families: For families who rely on their vehicles for daily transportation needs, ensuring that their car is protected with comprehensive collision coverage is crucial. Our coverage helps maintain the family's mobility by covering the costs of repairs, ensuring that you are not left without a vehicle in the event of an accident. Whether you drive a family SUV or a minivan, our collision coverage provides the peace of mind you need to keep your family on the move.

- auto

Comprehensive Coverage

Comprehensive coverage from DMS Insurance offers extensive protection against a wide range of risks that could damage your vehicle, beyond just collisions. This includes coverage for theft, vandalism, fire, natural disasters, and other non-collision-related incidents that can result in significant financial loss. At DMS Insurance, we understand that your vehicle faces various risks every day, and our comprehensive coverage ensures that you are protected from these unpredictable events. Whether you own a luxury vehicle, a classic car, or simply want to ensure that your vehicle is fully protected, comprehensive coverage is an essential part of your auto insurance policy. Our comprehensive coverage is designed to offer the highest level of protection for your vehicle, covering not only the cost of repairs but also providing compensation for total loss in the event that your vehicle is stolen or damaged beyond repair. This coverage is particularly important for those who own high-value vehicles, as the cost of replacing these assets can be substantial. In addition, our comprehensive policies often include additional benefits such as rental car coverage and roadside assistance, ensuring that you have the support you need in any situation.

Key Points

Non-Collision Protection: Comprehensive coverage provides protection against incidents like theft, vandalism, fire, and natural disasters, ensuring that your vehicle is covered for more than just accidents on the road. This coverage is crucial for safeguarding your investment against a wide range of potential hazards. Whether you park your vehicle in a secure garage or on the street, our comprehensive coverage ensures that you are protected against the unexpected.

Total Loss Benefits: In the unfortunate event that your vehicle is stolen or damaged beyond repair, comprehensive coverage offers compensation to help you replace your vehicle, minimizing your financial loss and ensuring that you can quickly get back on the road. This benefit is particularly valuable for those who own high-value vehicles or classic cars, as the cost of replacement can be significant.

Additional Benefits: Our comprehensive coverage often includes additional benefits such as rental car coverage and towing services, providing you with continued mobility and convenience even when your vehicle is out of commission. These additional benefits are designed to ensure that you are not left without transportation, no matter what happens to your vehicle.

Ideal Points

High-Value Vehicles: Protecting luxury or classic cars from a variety of risks is essential, and comprehensive coverage provides the necessary protection to keep your investment safe. Whether you own a high-end vehicle or a cherished classic, our coverage ensures that your car is protected against a range of potential threats. We understand the unique needs of high-value vehicle owners, and our policies are designed to provide the highest level of protection for your assets.

All-Weather Drivers: If you frequently drive in areas prone to natural disasters or severe weather, comprehensive coverage shields your vehicle from these unpredictable events, giving you peace of mind no matter where you go. This coverage is especially valuable for those who travel through areas where weather-related damages are common. Our comprehensive policies are designed to provide the protection you need, regardless of the weather conditions you may encounter.

Frequent Travelers: For those who travel often and park in unfamiliar areas, comprehensive coverage ensures that your vehicle is protected from theft, vandalism, and other non-collision-related incidents. This coverage allows you to focus on your journey without worrying about the safety of your vehicle. Whether you’re traveling for business or pleasure, our comprehensive coverage provides the security you need to enjoy your trip without concerns about your vehicle’s safety.

Testimonials

Emmett, A

I couldn't ask for a better agent then Doug, he's great and makes you feel like family!

Roy, R

Kept me up to date on change and explained it. Easy to get a hold of and answered all my questions.

Ian, M

Doug has been fantastic. I looked for quotes online and he was the first one to call. He answered every question and was very personable. I felt he always had my best interest at heart.

Frequently Asked Questions

Common Questions Answered for your convenience.

What types of vehicles do you cover?

We provide comprehensive car insurance coverage for a wide range of vehicles, including sedans like the Toyota Camry, Honda Accord, and Nissan Altima. Our policies also extend to classic cars, offering specialized classic car insurance that ensures your vintage vehicle is fully protected. In addition, we cover a variety of other vehicles, such as SUVs, trucks, and even sports models like the Mitsubishi Lancer and BMW 3 Series.

Can I get a policy if I have a history of accidents or financial issues?

Yes, DMS Insurance offers policies tailored to meet the needs of all drivers, including those with a history of accidents or financial challenges. We provide options for those with low credit scores, ensuring you can still secure reliable coverage. Our insurance agents work with multiple insurance groups to find the best rates, including options for the cheapest auto insurance and full coverage policies. We also offer flexible payment plans to accommodate your financial situation.

Do you offer quotes online or over the phone?

Absolutely. You can request a quote directly through our website or by calling us on your mobile phone. Our insurance brokers are ready to assist you with personalized car insurance quotes, ensuring you get the best possible rate for your needs. Whether you're looking for auto insurance in Tacoma, WA, or elsewhere in the Puget Sound region, we can provide a quick and accurate insurance quote to help you get started.

What types of coverage do you offer?

DMS Insurance offers a wide range of coverage options, including full coverage auto insurance, liability coverage, and specialized policies for unique needs such as bodily injury liability and insurance for vehicles with sunroofs or turbochargers. We also offer insurance for businesses, including LLCs, ensuring that your company's assets are fully protected. For those who own boats, we provide comprehensive insurance boat insurance, covering both personal and commercial vessels.

Do you work with independent insurance agencies?

Yes, DMS Insurance is an independent insurance agency, allowing us to offer a broad selection of policies from various insurance groups. This independence enables us to provide competitive rates and tailored solutions for our clients. Whether you're looking for car insurance cover or need specialized options like classic car insurance or insurance for high-performance vehicles, we have the flexibility to find the right policy for you.

How can I ensure I'm getting the best rate?

To ensure you're getting the best rate, it's important to compare quotes and coverage options. At DMS Insurance, our insurance brokers can help you navigate the process, offering personalized advice and multiple options. Whether you're refinancing an existing policy or securing new coverage, we make it easy to understand your options and select the best plan. We also recommend providing your zip code when requesting a quote to ensure we capture any local discounts available in the Puget Sound region.

Can I insure a used car with DMS Insurance?

Yes, we offer comprehensive coverage for both new and used cars, ensuring your vehicle is protected regardless of its age. Whether you're driving a used Chevrolet Malibu or a pre-owned Subaru WRX, our policies are designed to provide robust protection. We also offer additional options like full coverage and roadside assistance to give you peace of mind on the road.

What makes DMS Insurance different from other providers?

As an independent insurance agency, DMS Insurance offers personalized service and a wide range of coverage options that larger companies may not provide. Our commitment to customer service and our deep understanding of the local market, particularly in Tacoma and the greater Puget Sound region, set us apart. Whether you're looking for auto insurance in Tacoma, WA, or specialized coverage like full coverage for a classic car, we strive to exceed your expectations at every turn.

Do you offer coverage for luxury vehicles and high-performance cars?

Yes, we offer specialized insurance policies for luxury vehicles like Infiniti, Mazda, and Pontiac, as well as high-performance cars like the Mitsubishi Lancer Evolution and Chevrolet Camaro. Our policies can include features like full coverage, protection for specific components like brakes and wheels, and even coverage for unique features like sunroofs and turbochargers. We also provide options for drivers in need of comprehensive coverage for their entire fleet, whether it's personal or business-related.

How do I start the process of getting insurance with DMS Insurance?

Starting the process is simple. You can visit our website to request a quote, or contact one of our insurance agents directly by phone or email. Our team will guide you through the process, helping you select the best coverage for your needs. Whether you're seeking a car insurance quote, full coverage for your vehicle, or insurance for your LLC, we're here to help you every step of the way. Additionally, our partnerships with groups like Alliance West Insurance ensure that you have access to a wide range of options to suit your specific needs.